HARARE – A new Z$10 note will enter circulation on Tuesday, May 19, the Reserve Bank of Zimbabwe announced, while a Z$20 note will become the highest denomination when it enters circulation in the first week of June

The apex bank says it is introducing higher denomination bank notes to increase the amount of cash in circulation, at a time inflation is soaring and pushing prices beyond the reach of the majority.

Withdrawal limits have also been raised from Z$300 per week to Z$1,000.

Zimbabwe brought back the discredited Zimbabwe dollar currency last year in June after a decade of dollarisation. The move failed to end severe cash shortages and unleashed inflation, which reached 676.39 percent in March, one of the highest in the world.

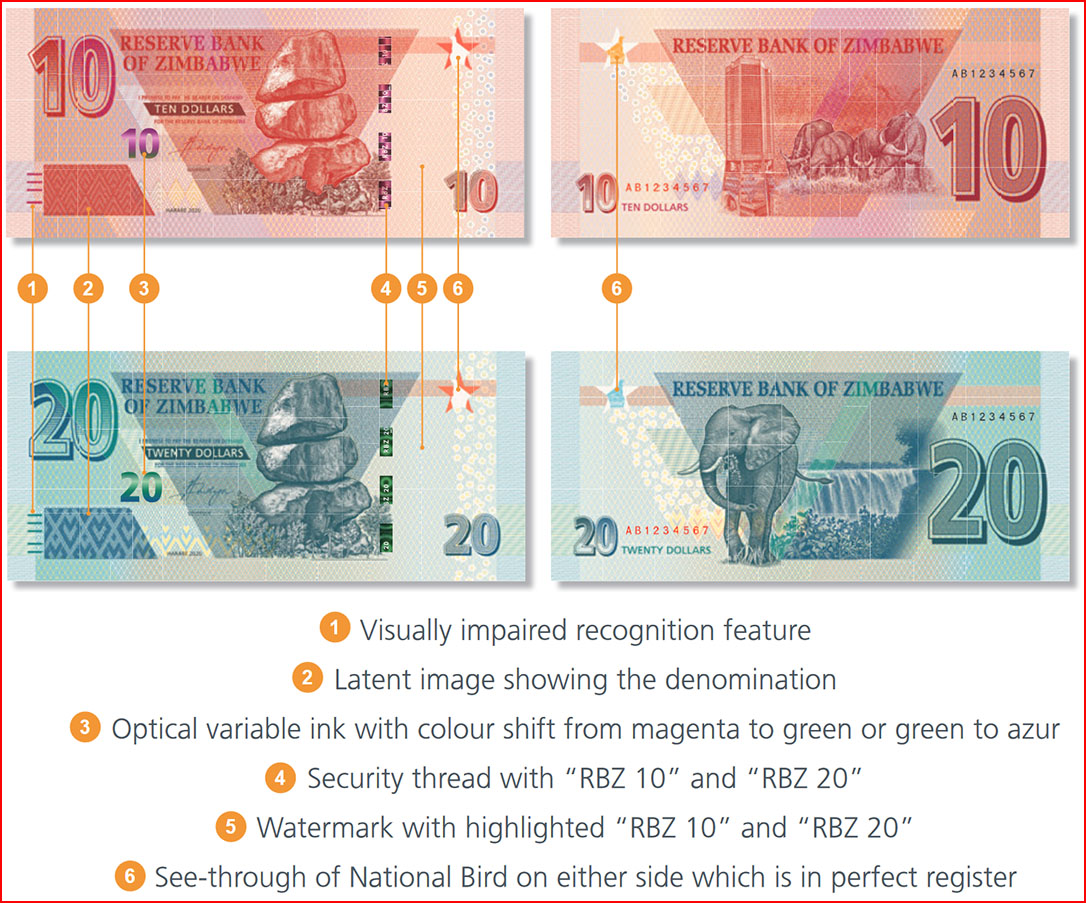

The design of the new notes mimics bank notes of the same value which vanished with the old currency abandoned in 2008 when hyperinflation forced the country into dollarisation.

The old notes are remembered fondly by older Zimbabweans, reminding them of an era of currency stability.

Until now, the highest denomination was a Z$5 bank note, which has become valueless. Even the new Z$20 (officially about US$0.80) cannot buy a loaf of bread, which was Z$33 on Saturday.

Although the central bank has previously said it would not print money to finance the budget, many Zimbabweans have bad memories of the central bank’s money printing activities that caused hyperinflation a decade ago, wiping pensions and savings.

Economic analysts say the government’s budget is under pressure from spending to combat the coronavirus outbreak, which will force authorities to resort to printing money, stoking inflation further.

ZimLive revealed earlier this week that the new bank notes, thought to be worth about Z$600 million, were printed in Leipzig, Germany, and delivered on May 14.

Inflation is seen ending this year way above the central bank and treasury’s target of 50 percent.

Zimbabwe is in the grips of its worst economic crisis in a decade, marked by shortages of foreign currency, cash, food and medicines.

Queues for cash outside banks are a common sight, and it remains to be seen if the central bank’s latest effort at taming cash shortages will bear fruit. The dramatic loss of value of the Zimbabwe dollar has forced Zimbabweans to carry huge piles of the worthless currency to complete simple transactions, and economists say the RBZ should have been printing notes in the Z$100 and Z$200 region if its aim was convenience.