HARARE – A storm of outrage has erupted across Zimbabwe following the Reserve Bank of Zimbabwe’s (RBZ) drastic devaluation of the Zimbabwe Gold (ZiG) currency by 44%.

Civil society groups, economists, and the general public have taken to social media, denouncing the impact of the devaluation on everyday life, with many accusing the central bank and the government of exacerbating economic hardships.

The Amalgamated Rural Teachers Union of Zimbabwe (ARTUZ) was quick to criticize the government, calling for immediate salary adjustments in line with the devaluation.

“Mthuli Ncube and the employing authorities should not wait to be told that since the ZiG has officially been devalued by 44%, the salary component in ZiG must automatically be adjusted. The stability of this Republic rests on the shoulders of workers,” ARTUZ tweeted.

Another critic, @Vahombe07, highlighted the dire consequences for civil servants and pensioners.

“If a civil servant earned 5,000 ZiG, the value of that money is now effectively halved. School fees and prices of basic goods are set to skyrocket by almost 100% to counterbalance the devaluation.”

Prisca Mutema, an outspoken commentator, noted that this devaluation has further eroded trust in the government and its monetary policies.

“The black market players have received a go-ahead from the government to bury the ZiG,” she warned, predicting inflation rates would rise sharply by the end of the year.

Mutema added that the government’s poor monetary policies would lead to a swift devaluation of the currency, forecasting the ZiG would plummet further by December.

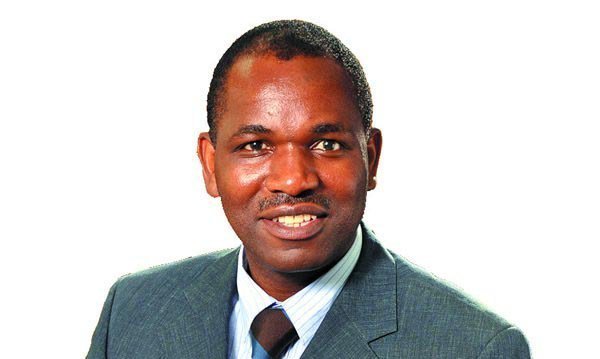

Zimbabwean born businessman-cum-lawyer Tawanda Nyambirai questioned the credibility of the central bank’s actions, noting that “The #ZIG is supposed to be anchored on gold. Since its introduction, the gold price has gone up significantly, yet the #ZIG has done the opposite. This devaluation undermines trust and creates the impression that the currency was anchored on lies.”

Economist Gift Mugano urged the government to scrap the ZiG altogether and return to the US dollar until economic fundamentals improve.

Kudzai Mutisi, a Zanu PF sympathizer and economic commentator, argued that the government’s understanding of “gold backing” was flawed, noting that merely holding reserves without deploying them to stabilize the currency was ineffective. “Filling a vault with gold and saying it’s backing a currency won’t create stability,” Mutisi tweeted.

Retailers and businesses, too, have been hit hard. The daughter of MDC leader Douglas Mwonzora – Bertha Mwonzora – lamented that the government’s actions are only fueling the black market.

@admiredube pointed out that the Zimbabwe Stock Exchange (ZSE) has lost an equivalent of USD 1.9 billion in market capitalization, with more volatility expected in the coming days.

Matigari aptly summarized, “This is playing with people’s lives.”

The RBZ’s move to hike interest rates and tighten monetary policy comes as inflation surges, with mounting pressure on the central bank to stabilize the economy.

However, Zimbabweans across the country remain skeptical, with many viewing the devaluation as a hammer blow to the embattled ZiG currency. Kukurigo