HARARE – Zimbabwe’s government on Saturday ordered banks to stop lending with immediate effect in a move President Emmerson Mnangagwa said was designed to stop speculation against the domestic currency and was part of a raft of measures to arrest its rapid devaluation on the black market.

Zimbabwe reintroduced a local currency in 2019 after abandoning it in 2009 when it was hit by hyperinflation. However, the Zimbabwe dollar, which is officially quoted at 165.94 against the U.S. dollar, has continued to slide on the black market, where it is trading between 330 and 400 to the greenback.

The black market exchange rate has moved from about 200 Zimbabwe dollars at the beginning of the year.

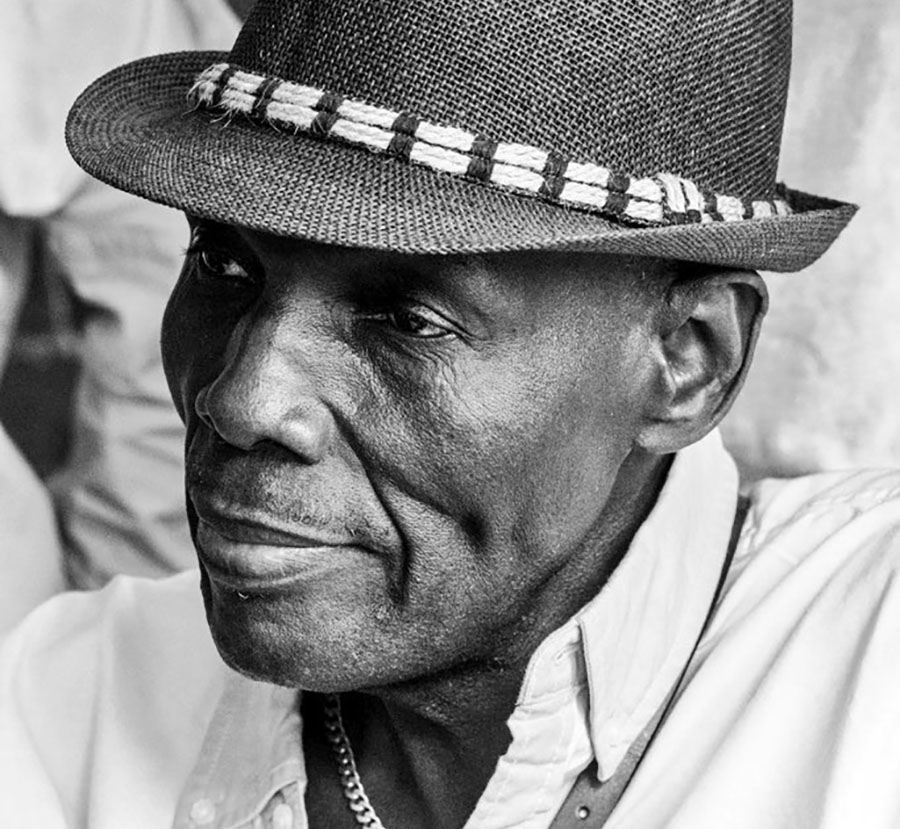

Mnangagwa on Saturday announced measures he said were meant to arrest the currency’s depreciation, which he said threatened Zimbabwe’s economic stability.

“Lending by banks to both the government and the private sector is hereby suspended with immediate effect, until further notice,” Mnangagwa said in a statement.

He accused unnamed speculators of borrowing Zimbabwe dollars at below-inflation interest rates and using the money to trade in forex.

Other measures include an increased tax on forex bank transfers, higher levies on forex cash withdrawals above US$1,000, and the payment of taxes which used to be charged in forex in local currency.

The main opposition Citizens Coalition for Change said: “We condemn the policy announcement by Mnangagwa that domestic foreign currency transfers now attract 4 percent intermediate money transfer tax. Cash withdrawals above US$1,000 now attract a 2 percent tax excluding bank charges. Why inflict maximum suffering on the people during these hard times?”

The devaluation of the Zimbabwe dollar’s black market exchange rate, which is used in most financial transactions in the economy, has been driving up inflation.

Year-on-year inflation quickened to 96.4 percent in April, from 60.6 percent in January.