Reverse Bank of Zimbabwe (RBZ) governor John Mangudya has ruled out prospects of Zimbabwe adopting the South African rand as its anchor currency.

This comes amid frenzied social media posts claiming President Robert Mugabe and his South African counterpart, Jacob Zuma, were close to reaching an agreement to enable Harare to join the Common Monetary Area — made up of South Africa, Lesotho, Namibia and Swaziland.

Giving currency to the speculation has been Mugabe’s visit to South Africa to attend the 2nd Session of the South Africa-Zimbabwe Bi-National Commission.

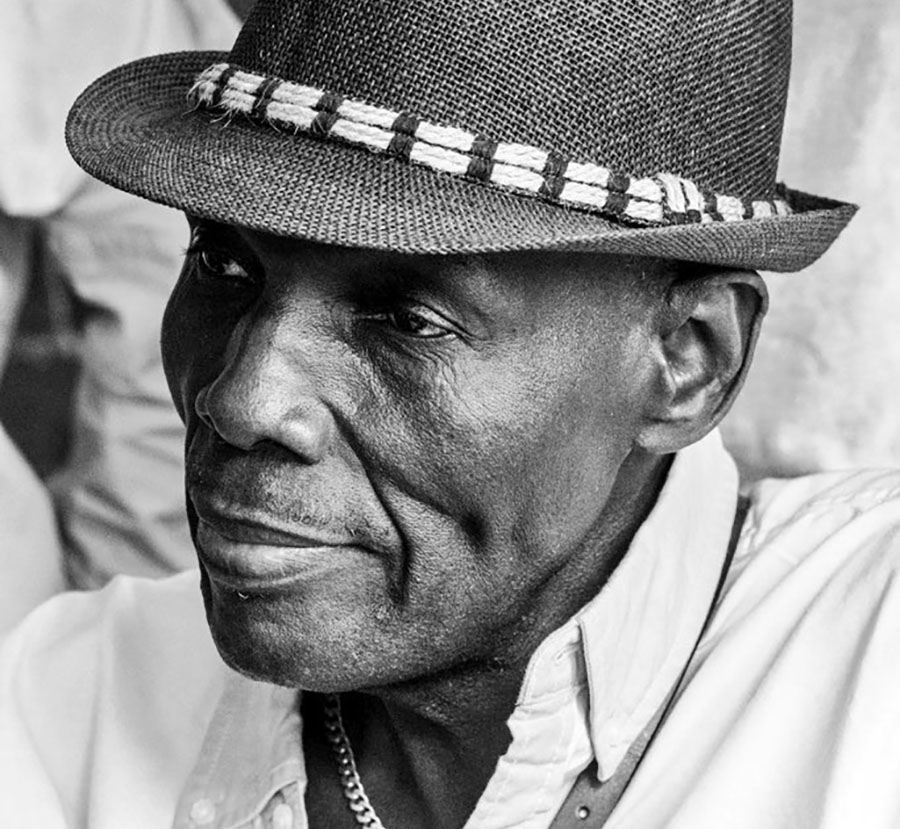

Mangudya poured cold water on the speculation yesterday.

“These are fake news, which have their own objectives. So the answer, in simple terms, is that the multi-currency system is remaining in Zimbabwe,” he told the Daily News.

“That’s government’s position and that’s not changing. If that was true, don’t you think I would have sent out a statement? Haa, this fake news ka, ichakunetsai (fake news will confuse you),” he added.

Zimbabwe is South Africa’s fifth largest trading partner in Africa.

Prior to the June 2016 restrictions on imports that were meant to protect local industries, Pretoria exported more than R230 billion a year to Zimbabwe.

Currently, Zimbabwe has a huge mismatch between its exports and imports, with the latter dwarfing the former.

This has given rise to a painful liquidity crisis which is not being helped by the fact that Zimbabwe is using a firming US dollar as its anchor currency, making its exports uncompetitive.

Zimbabwe abandoned its own currency in April 2009 as runaway inflation rendered it worthless.

Having consigned its medium of exchange to the dustbins of history, Zimbabwe opted for a basket of currencies that includes US dollars, SA’s rand, the pound and the Botswana pula.

In light of the cash constraints, industry has presented proposals to government to make the rand the currency of choice because of Zimbabwe’s strong trade links with SA.

Mangudya said while the rand will continue to be part of the multi-currency system, the conditions on the ground do not favour its adoption.

“I said the rand is part of our multi-currency system. No one is refusing to use the rand in this country,” Mangudya told the Daily News.

“Number two, the rand is foreign currency; you need to export to get rands. Number three, you cannot export gold or tobacco with US dollars and then sell our US dollars at the Reserve Bank of South Africa to get rands; does that make sense? Now you are holding a weaker currency from the stronger currency.

“…what I am saying is that this was a question for 2009 when we dollarised the economy; that is when this issue should have been discussed. If we don’t have a facility from SA, a loan facility, how do we get the rand?

“So it means you need someone to give you the loan facility. And my understanding, during the Government of National Unity — my understanding was that there will be a $1 billion facility from SA, that’s what I thought, that’s what I heard but we did not get that facility.

“But if today there is a facility that comes it means the money will be in the market…And also if we are now using rands, it means we need to change US dollar accounts and if I am to change people’s money and give them a currency with a lower value; imagine you are an exporter, tomorrow I change your money and give you rands, do you think that is normal?

“Aaaahh no guys or even yourself, your personal accounts from US into rands hamundirove (won’t you beat me)?” he asked rhetorically.

Veteran economist, John Robertson, said Zimbabwe would need South Africa’s permission to adopt the rand adding Pretoria “would never give that permission if Zimbabwe’s behaviour seemed likely to undermine the stability of the rand.”

He said Zimbabwe would have to meet all the requirements of the Common Monetary Area, made up of SA, Lesotho, Namibia and Swaziland.

“This makes movements of capital and goods very mobile across the region, but disciplines have to be imposed by the SA Reserve Bank on the central banks of the member countries to keep the arrangements under control.

SA would have to impose the same disciplines on Zimbabwe.

“Current thinking in Zimbabwe suggests that the country would be highly unlikely to accept strong SA influence over Zimbabwe’s monetary policy.”

Chantelle Matthee, an analyst at NKC African Economics, said the real issue relates to how Zimbabwe is going to gain access to sufficient amounts of the currency for it to improve domestic liquidity, be it through a pegged arrangement or simply adopting a foreign currency as the sole exchange medium in the country.

“Adopting the rand should make trade between Zimbabwe and SA easier, but domestic production would still need to be ramped up for Zimbabwe to generate more rands through exports, and the mere adoption of the rand would not necessarily incentivise increased domestic output, especially if the currency comes under pressure and exporters prefer to be paid in US dollars,” she told the Daily News.

“Adopting the rand would also mean Zimbabwe gives up the independence of monetary policy and could also expose the country to shocks in South Africa, but aligning policy to that of its larger neighbour would not necessarily be a bad thing as it would be accompanied by increased stability and transparency.”

University of Zimbabwe economics professor Ashok Chakravarti said there were no major economic issues to ponder about in adopting the rand tomorrow.

“All it needs is a simple law, a statutory instrument from government with an exchange rate re-denomination of all US dollar balances, salaries and prices,” said Chakravati.

“The rand is also a non-convertible currency that will remain in the region and, therefore, cash will be maintained.”