DID you know that brewing, which is the process of manufacturing beer is considered the oldest secondary industry in Zimbabwe? In fact, the first beer sales were recorded as early as 1899 under the Salisbury Larger & Beer company, which paved the way for the modern-day Delta Corporation. Over a century later, beer continues to find innovative ways to make it to the headlines.

However, modern-day Delta Corporation is not only a brewery. It also sells soft drinks, which it classifies as sparkling beverages and sorghum beer in addition to the lagers. It also has an investment in Schweppes which manufactures and sells cordial drinks including the famous Mazoe brands and another investment in African Distillers which manufactures wines and spirits. The beverages giant now also has operations in South Africa and Zambia.

At some point, it also had a significant stake in Ariston Holdings, which is into tea manufacturing. Such that each time you open your mouth to drink something, there is a fair chance that your money is going to Delta somehow. This is why it is such an important company to any analysis of the Zimbabwean economy, besides the fact that it is the largest locally listed company.

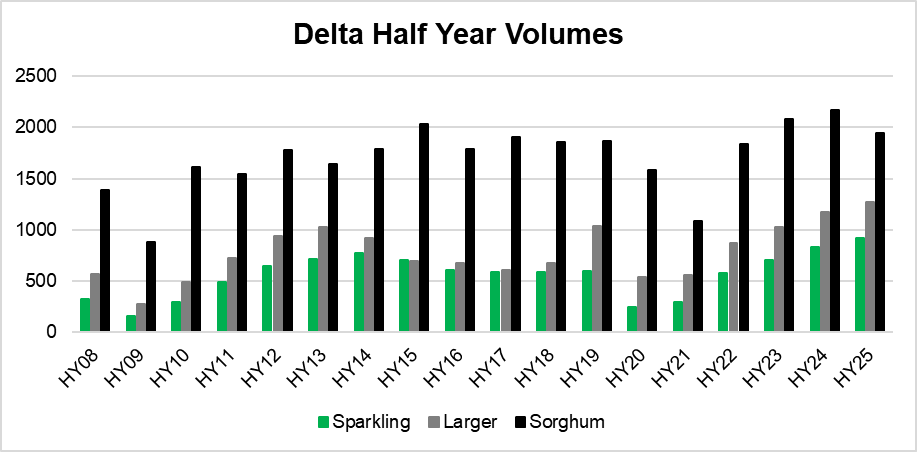

The Zimbabwe Stock Exchange-listed beverages manufacturer released its half-year results for the 2025 financial year, where the volumes of sparkling beverages and lagers grew but saw a decline in the sorghum beer. In this article, we will break down the Delta numbers and extract some interesting insights.

Clear beer, in the form of lagers, is a critical part of Delta’s business. This is because it is the largest revenue driver and the most profitable beverage. Using the latest financial statements, 42% of the group’s revenue came from larger sales and has on average contributed the lion’s share. With a segment operating margin of 28%, lagers also contributed over 70% of overall operating profit. In terms of unit sales, Delta sold 1.275 million hectoliters over the six months, representing a 9 per cent increase from comparable period volumes.

The volume growth in the lagers division was attributed to the ability of the group to effectively supply enough to meet the growing demand. Delta has been pouring investments into glass bottle manufacturing, and this has also had a positive impact on the volumes sold. The company also believes that increased brand awareness had a role to play in pushing those volumes as they devoted to sponsorship in the sports, arts and entertainment space.

In addition to clear beer, Delta also sells opaque beer which is classified as sorghum. This is more of the volume driver but with lower margins compared to the premium clear beer. In the 2024 full year, Delta recorded the highest sorghum volume sales in 25 years, and the numbers have reverted. In the period under review, 1.942 million hectoliters were sold here in Zimbabwe, 11% lower than the comparable period, however representing 47% of local volumes sold, excluding volumes from investee companies and associates.

Delta also sells opaque beer in the region and sold 517 thousand hectoliters, down 20% versus the comparable period. By the way, 1 hectoliter represents 100 liters. The Zambia volumes, although taking a knock, are still above the 5-half-year average of 487 thousand hectoliters. The Zambia operations are done by a company called Natbrew, which Delta wholly owned since 2020. In South Africa, the sorghum beer volumes also came off 8% to 719 thousand hectoliters. This is also still above the 5-period average of 621 thousand hectoliters, and it speaks to how good HY24 was.

The overall sorghum beer volume drop was attributed to lower disposable incomes which were caused by the drought. If at least 60% of Zimbabweans live in the rural areas, sorghum beer is more popular there and their primary source of livelihood is agriculture, then a drought has a negative impact on their spending habits. The drought also pushed the costs of cereals like maize and sorghum and subsequently pressured the price of the beer. On average the drought-induced price increase on cereals was between 6 – 27%.

Delta also caters for the teetotalers. However, these were significantly affected by the “sugar tax” that was introduced in the 2024 National Budget. Between February and the end of September 2024, Delta paid a cumulative US$20.5 million in sugar tax and estimates it would have paid US$32 million by the end of the year. The tax is mainly on carbonated soft drinks and the cordials and juices, with a small portion on alcoholic beverages.

Nevertheless, the sparkling beverages witnessed a 10% volume growth to 919 thousand hectoliters. Sparkling beverages also contributed 19% towards the overall revenue, up 3 percentage points versus the comparable period. The operating margin for the sparkling beverages was only 7%, and its contribution to the overall operating margin was 8.5%.

Volume growth was also recorded in the wine and ciders division sold under Afdis. Wines were up 13% to 4.4 million liters, whilst ciders grew by 22% to 44.9 million liters. Afdis also sells spirits, whose volume was stable at 35 million liters. The growth in volume was attributed to increased supply chain management whilst caution in the spirits division was highlighted given the cheaper illicit imports, that are bringing competition.

Amid the currency crisis in the country, last year Delta decided to change its reporting currency to USD, to align with the functional currency. By then, the USD portion of sales had stabilised around 90%. However, since the introduced of the Zimbabwe Gold (ZiG) currency, the USD portion of sales came off to the sixty per cent range before gradually reverting to the eighty–ninety per cent range.

The ZiG has lost over forty per cent of its value since its inception, and that also puts pressure on the financial numbers to give a clearer picture of the operations. According to the management’s own admittance, the true revenue growth could be in the region of 3% versus the 11% implied by the financial statements. This is why we spent more effort looking at the volumes and ratios than the absolute values.

Delta seems to be having a fairly good year despite obviously the sorghum division which is weighing it down. The sugar tax is here to stay and is the new reality and I think going into the future the company might need to gradually reduce its exposure in that section, already it only contributes 20% towards the top line, and the competition is also excessive.