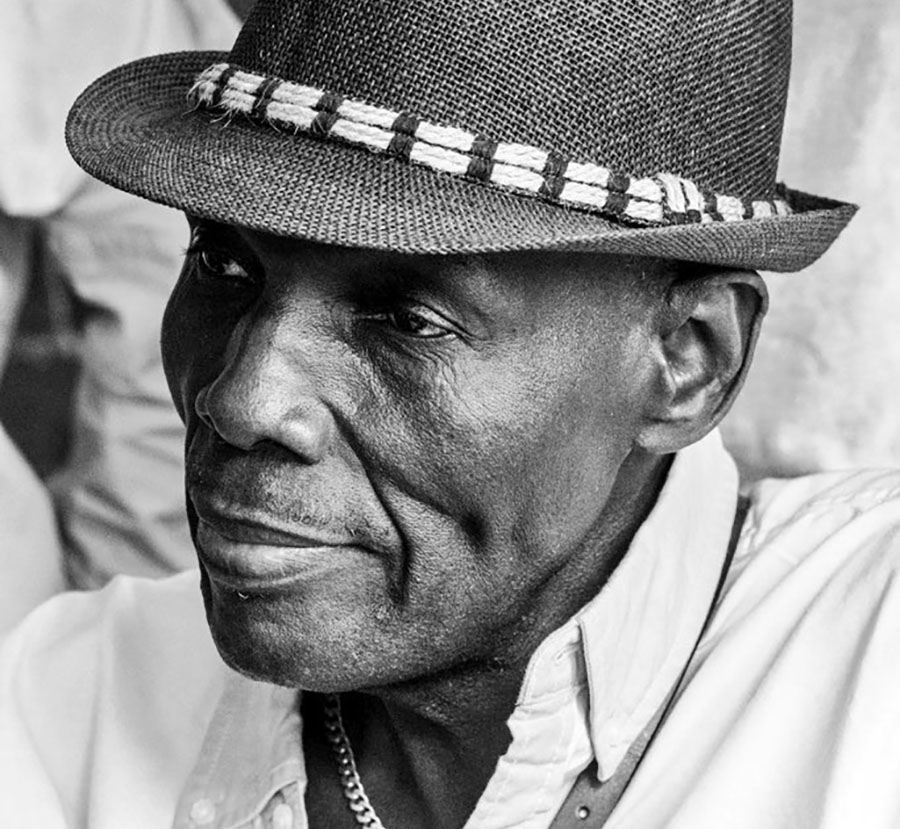

For a year, Eddie Cross sat on the Reserve Bank of Zimbabwe’s Monetary Policy Committee, before he was fired for being too outspoken. In a recent interview with TechZim, he reveals why he is “not unhappy” with the foreign currency exchange black market. Here is his reasoning:

“Today if you put a million United States dollars on the table in the informal market you will find great difficulty in finding a buyer. I have a friend who is a money trader, he tells me for sums from US$10,000 and above they will pay 138:1, they don’t want NOSTRO, they want cash.

So who is buying at those rates? It’s the smugglers. So people who are buying gold, they need cash. They are buying gold in Zimbabwe at the moment for 60 percent of its real market value. They then take the gold, they smuggle it to South Africa and it’s refined in a refinery. They then either sell it in South Africa for rand, if they get paid in rand they then sell the rand in South Africa to a Zimbabwean importer – OK Bazaars, TM Supermarkets – for a premium.

The local company, TM or OK, pays them out in Zimbabwe for RTGS at a premium and they take the RTGS and they get back in the market and buy more United States dollars.

On top of that, you have these runners. My guess is that 30 or 40 percent of all imports into Zimbabwe are being managed by runners. These runners operate entirely on cash, they pay the border some bribes, they don’t pay taxes, they don’t pay VAT. You get stuff delivered to your door cheaper than you can import it for yourself, but you have to have cash US dollars. That’s where these wild rates are coming from.

I spoke to a major transporter in Bulawayo and he said all our spares are brought by runners, we cannot compete with them. Nobody will tell you who is behind these runners. I know because I have a friend who is a money trader. Let’s say I need RTGS or vice versa. He gives me a rate. I can tell you the RTGS is in my bank account before I hand him the cash. It’s very efficient.

I am not unhappy about the parallel market. I in fact think if there is a big premium, you know who is getting the benefit of that? It’s the guys who are receiving money from abroad, the remittances. In my view, the remittances are US$3 to US$4 billion a year, and those people are getting their remittances in cash.

Mukuru operates in South Africa and they have three million clients. Average transfer per month last year was US$79, or US$69, and that’s US$3 billion, all in cash. Quite frankly, if I was a guy living here and I got US$1,000 from my relative in the United States and I took it into the informal sector and I got RTGS$140,000 for that, I would be sitting pretty and that is where the building boom is coming from, it’s getting into the pockets of the right people. That is why remittances are growing at the moment, it’s because the guys remitting money to parents are getting phenomenal returns on the cash.

In my home in Bulawayo, we have a whole suburb near me which is being developed by diaspora people. One of them, a doctor in the UK, has built this magnificent home and he furnished it, and he was doing it with remittances to Zimbabwe and he told me he got a massive return on his pounds delivered here in the local currency and he was able to build for next to nothing. For me that’s all positive.

The reality is if we put all our foreign exchange on the market, in a real auction today, the currency would actually strengthen, that’s the reality. 85 would be too weak. I think we would then have to buy foreign exchange on the market to maintain a weak currency because we need a weak currency, we don’t need a strong currency.

If you ask any exporter, they will tell you they are not getting a fair price for their foreign exchange but the reality is if you look at their books, they are making money. Look at Zimplats, on a billion-dollar turnover they made US$500 million profit, they paid a divided of US$200 million. Where on earth do you ever see a mining company pulling those kind of returns, and then you tell me 85 to 1 is not good enough? They see those rates in the informal sector and they say we want those rates, but those rates are not justified. I don’t think so.

I am not unhappy with the present situation at all. If I were the governor of the Reserve Bank, I would be quite pleased, but what we have got to do is to extend the flow of foreign exchange across the auction and I would love to see the banks coming to the party, I would love to see everyone coming to the party. For example, these NGOs are getting paid in foreign exchange and paying their staff in foreign exchange, I would like to see them put their money onto the market and pay their staff in RTGS dollars, and they are contributing to the national good.

I have been told by lots of businessman they can handle about Z$100 to US$1. I think we should allow the auction rate to depreciate to that sort of level. I think it’s a good thing if we move towards convergence, but let’s not sacrifice the welfare of the majority for the benefit of a minority of exporters.

I also must dispel the myth that the auction rate is managed. It’s not managed, that rate is driven by the buyers. We have been cutting applications below 85 now for four weeks and it hasn’t made any difference at all to the bids. I have a friend running a major business and he applies for US$500,000 every week and he has been depreciating his bids, he is now at 86.5 to be safe, and other guys are bidding 81 or 82, this is nonsense. That’s just trying to get US dollars at an artificially cheap price. We ought to cut these guys off altogether.”

(Please note the interview was conducted in July, and the rates have since shifted. Official rate is now 1:88.55, and the black market rate is anything between 140 and 170)