HARARE – Employees of two Zimbabwean banks have been accused of dealing in counterfeit United States dollar bills, but the banks deny the claims.

A woman has filed a complaint after she says a CBZ bank teller slipped in two fake US$100 bills while she was making an over-the-counter withdrawal of US$500.

In a separate case, a man is suing Stanbic bank accusing a bank teller of switching his good bank notes he wanted to deposit for fake notes, which the bank says it destroyed.

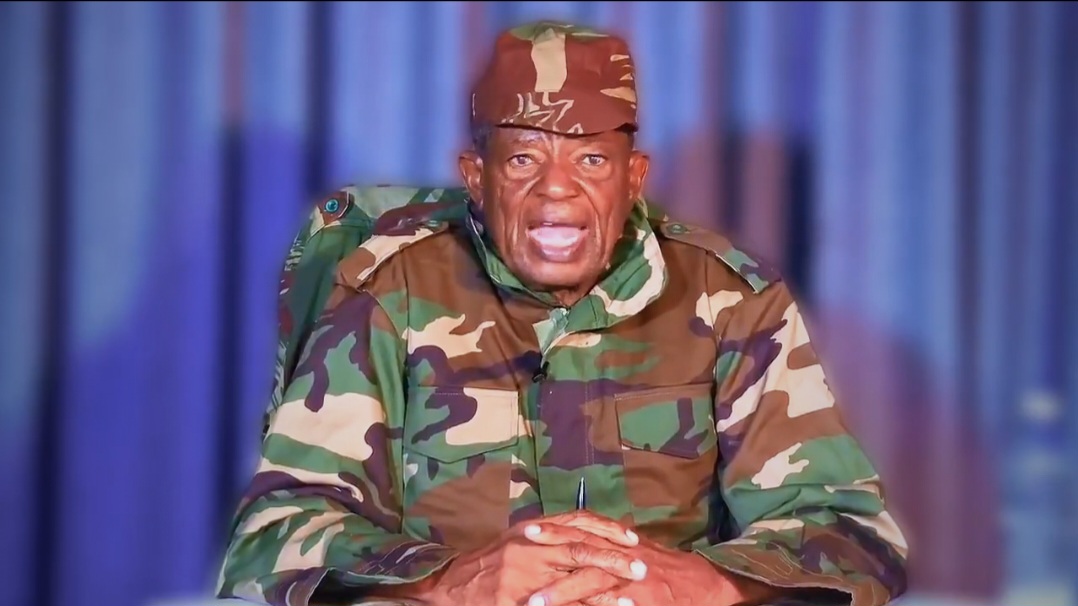

International sports administrator Tanyaradzwa Nzvengende says she withdrew money from CBZ’s Westgate branch in Harare at the end of May this year and was handed five crisp US$100 bills.

Nzvengende flew to New York in the United States a week later where she attempted to make a purchase with one of the notes, beginning a frustrating process to get the bank to admit that it has corrupt employees who are “cleaning” fake notes by giving them out to unsuspecting customers.

ZimLive has seen a series of messages Nzvengende exchanged with CBZ, starting on June 12 when she first lodged a complaint.

CBZ ignored most of her communications and dragged its feet until September, when the bank finally told Nzvengende that she had filed her complaint late and that in any case their systems were thorough and such a fraud could not have occurred in their bank.

The communications seen by this website cast doubt on CBZ’s contention that the complaint was filed late.

In the first message sent to the bank through their Facebook page, Nzvengende wrote: “I’m currently in New York and have had one of the $100 notes I got from the bank rejected. How is it possible that a bank issues fake notes? I’m back on June 17, please advise who I can come see about this. This is not right! I’m far beyond disappointed.”

In a subsequent e-mail to the bank on her return, she said the note was confiscated while attempting to buy lunch at a United Nations cafeteria.

“Thank heavens they did not call the police on me… When I got back to the hotel, I carefully scanned all the notes I had and realised that there was also another fake $100 note among the four remaining notes,” she wrote, adding that she had returned home with the fake note which she presented to the bank to commence its internal investigation.

On June 20, she wrote again to the bank saying the branch manager, Kudzai Munetsi, had failed to respond to her e-mail to arrange an appointment.

“I decided to go to the bank, the branch manager wasn’t in. I decided to leave a message at the information desk, the desk wasn’t manned. I’m travelling this Sunday and would like to get this resolved before I do so. Can you PLEASE handle this!” she pleaded.

Nzvengende said she was promised that an investigation had been commenced, and the matter dragged into August.

On August 2, she wrote to Munetsi, saying she had been “grossly inconvenienced” and demanding to have the matter “resolved immediately.”

“US$200 might not be much to your institution, but it surely is a lot of money to me,” she said.

Eventually on September 12, the bank e-mailed Nzvengende to say it was sending its officials to meet her.

“They had a series of questions, and they presented some scenarios which all absolved the bank. One of their arguments was that perhaps someone swapped the notes when I got home, but I live alone. In the end, they said their systems were very robust and they don’t think I got the notes from their bank,” Nzvengende told ZimLive.

In a statement, CBZ said: “Investigations conducted revealed that the customer’s cash withdrawal transaction was handled procedurally by the branch and there was no evidence that the counterfeit notes originated from our bank.”

Nzvengende said she is now taking legal advice.

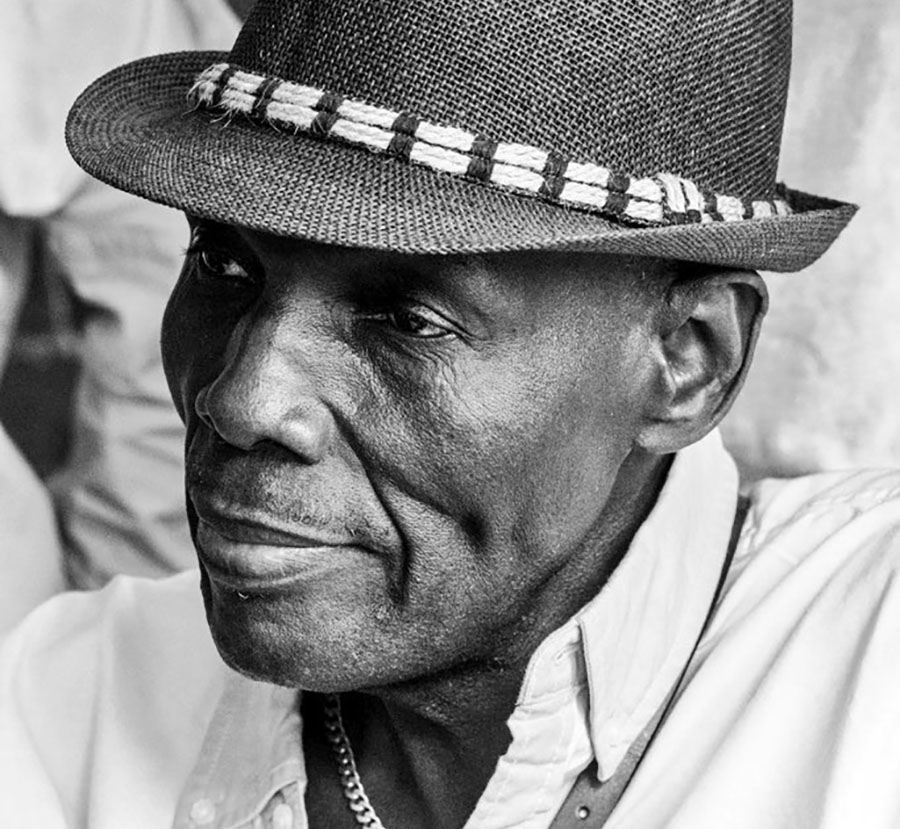

In the Stanbic case, Harare man Brian Munyanduri has gone to the High Court demanding his US$1,250 back from the bank which he says was confiscated as fake money.

In an affidavit, Munyanduri says he sent his cousin, Prisca Mudondo, to make a deposit into his foreign currency account held with the bank on July 8. The money was for his mother’s treatment in South Africa, he said.

Munyanduri says after initially taking the money and counting it, a bank teller then returned it to Mudondo and asked her to come back with the account owner.

“The money was returned to the applicant, a confirmation that it was genuine,” Munyanduri’s lawyer Tawanda Kanengoni said in his affidavit.

When they returned a day later to effect the deposit, Munyanduri says they were advised that the 25 bank notes of US$50 each were fake before they were confiscated pending further verification.

Munyanduri returned to the bank on July 16 for a meeting with bank officials and was advised by one Mudekwa that the notes had been found to be counterfeits and had been destroyed.

“The first applicant (Munyanduri) was not satisfied with the conclusion by Stanbic employees as they did not show him the findings to that effect, and also did not show him the perforated US$50 x 25 notes for him to confirm that the serial numbers matched with his confiscated notes,” Kanengoni is arguing.

In any event, if indeed the notes were found to be fake, Munyanduri and his lawyers say a switch would have occurred inside the bank, possibly when Mudondo tried to make a deposit but was given the money back to return with the account’s owner. Mudondo was fully empowered to make a deposit without a requirement of the account’s owner being present, they argue.

Munyanduri, the court papers show, took the matter up to the Reserve Bank of Zimbabwe (RBZ) seeking to cause proper verification of all his bank notes.

He says in his affidavit that the RBZ advised that he was entitled to be shown documents proving that his money was fake. The central bank also told him that Stanbic was supposed to have shown him his unperforated notes for verification against the recorded serial numbers in order for him to confirm that the so deemed counterfeit notes belonged to him.

Munyanduri said he is able to identify his notes which were a bit soiled after he stored them in a cooler box at home.

“The money I intended to deposit was soiled as it had been stored in a cooler box and eventually had been attacked by moisture,” he says in his affidavit.

He also argues that the money was being kept as US$1,300 in the cooler box, and he took a US$50 note from the same bunch and deposited it with another bank with no trouble.

A Stanbic statement said the matter was before the courts, but they would be defending the claim.

Have you been issued counterfeit United States dollar bills by a bank? We would like to hear from you. Contact our WhatsApp line +27721012821