HARARE – The price of bread will go up $0.30 with effect from Friday, the National Bakers Association of Zimbabwe (NBAZ) announced on Thursday.

A standard loaf will now cost $1.40, the NBAZ announced.

The new price is lower than the $2.20 that the bakers had wanted to charge last week before the government sought crisis talks.

The bakers only backed down after the Reserve Bank of Zimbabwe (RBZ) agreed to meet 80 percent of their foreign currency requirements to fund imports for wheat, which is in short supply in the country.

Previously, the RBZ was availing just 35 percent of the foreign currency the bakers had requested.

“We have made every effort to keep the bread price affordable,” the NBAZ said in a statement. “We therefore notify the public that the price of a standard loaf should not exceed $1.30 and $1.40 to the wholesale and consumers respectively, flour being at a maximum price of $36.50 per 50kg bag.

“This watered-down increase has been arrived at following the government’s intervention through the RBZ that has committed to avail to the bakery industry at least 80 percent of its monthly foreign currency requirements from a current maximum of 35 percent allocation.”

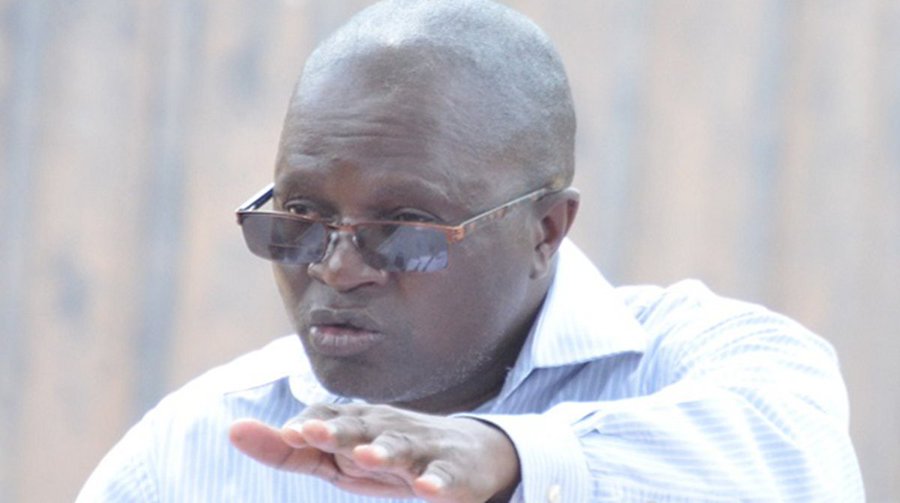

Industry and Commerce Minister Mangaliso Ndlovu said: “They really did not need our permission to do that (increase the price), but they notified us. They initially wanted it to be $2.20 (but) then we had to come up with ways of mitigating that and there is now more assistance that they are getting which could not be 100 percent really, to keep the prices where they were.

“So they told us that with the assistance and having looked at their costs and having looked at everything, the wholesale price from the manufacturers will be $1.30 and from the retailers it will be $1.40.”

Commodity prices have shot up across the board, most of the increases triggered by a shock 2 percent tax on all electronic transactions announced by the Ministry of Finance on October 1.

An RBZ directive for banks to separate foreign currency accounts from RTGS accounts also severely devalued the surrogate bond note currency.

Companies are now forced to buy foreign currency at a premium on the black market in order to finance imports, which has seen prices galloping out of range for most Zimbabweans whose salaries remain at the pre-October 1 levels.