…failed investment sparks mayhem

MUTARE – Redwing Gold Mine, once touted as a giant gold mining venture capable of transforming the quality of life in the Penhalonga area of Manicaland province and a cash cow for the national economy, has become a sad story of failed investment by British-registered Metallon Corporation.

Metallon’s vast Zimbabwe mining portfolio extends to subsidiary firms, Shamva, Mazowe and How Mine.

The gold mine, situated 50 kilometres west of Mutare, had a resource of 2.5 million ounces of gold, according to the Mineral Reserve Statement of December 2016.

In its heyday, the mine played a major role in economic stabilisation and domestic resource mobilisation, producing 1.1 million ounces of gold between 1966 and 2004.

But the story has changed to that of dismay; manifesting in death, massive environmental damage, infrastructural decay, labour rights abuses, crime and sleaze — all in one.

Civil society groups say more than 100 people have died at the mine since 2020, with 26 dying in January this year alone.

The rot does not end there, as there has been flagrant disregard for mining statutes through political patronage, tax evasion, mineral smuggling, and human rights abuse, according to civil society groups closely monitoring the situation.

An investigation by ZimLive in collaboration with Information for Development Trust (IDT), under a project meant to support investigative reporting focusing on the accountability and governance of foreign interests and investments in Zimbabwe and southern Africa, confirms the rot, at the once-thriving mine, which has been hijacked by politically connected individuals.

Ownership

Under the Metallon family, Redwing is owned and operated by United Kingdom-registered King’s Daughter Mining Company Limited, which holds 100% shareholding in the firm.

The company is run by South African business mogul Mzi Khumalo.

Mismanagement and litigation

Owing to a litany of mismanagement practices that placed the once thriving business on the edge of a precipice, Metallon Gold subsidiaries Mazowe, Shamva and Redwing Mine were placed under corporate rescue by the High Court in July 2020 after workers’ unions and creditors successfully sued for failure to honour wages and contractual payments amounting to millions of US dollars.

Under High Court 2619/19, company creditors Shatirwa Investments sued Metallon Gold, Gold Field of Mazowe and Goldfields of Shamva claiming it was owed US$6 394 232.

“The 1st and 2nd Respondents are jointly and severally liable to the applicant in the sum of US$6 394 232.00 in terms of court order in HC 6197/18…” read the application in part.

The debt arose after Shatirwa Investments had rendered mining services to Metallon Gold and Mazowe Gold for operations between August 2016 and February 2018 which were never paid for.

Reggie Saruchera of Grant Thornton was appointed corporate rescue partner.

Associated Mine Workers’ Union of Zimbabwe (AMWUZ) filed a concurrent suit against Metallon Gold and Redwing Mine under Mutare HC99/2019.

According to lawyer Reynos Gumbo, Redwing Mine owed AMWUZ US$29 500 in outstanding union fees.

“Fees were deducted from the workers’ salaries but were not remitted to the union,” Gumbo said.

Redwing workers also said they were owed in excess of US$4 million in outstanding wages as of 14 August 2019. Wage arrears had accrued over four years.

According to Gumbo, Redwing failed to remit fees to the Mining Industry Pension Fund (MIPF) for six years. The company was also not making National Social Security Authority remittances although it was effecting deductions from wages.

In addition, Redwing was holding on to pension and funeral services payments for workers despite effecting deductions.

“The company was deducting employees’ monies but not remitting them to MIPF and owed other creditors various amounts of money,” Gumbo said.

However, the corporate rescue order was successfully appealed on a technicality through the Supreme Court after Metallon challenged the locus standi of the litigants, arguing they did not sufficiently satisfy the “affected persons” clause stipulated in the Insolvency Act for one to sue.

Under the Insolvency Act of 2018, affected persons who include shareholders, and trade creditors can apply for corporate rescue if the company is in financial distress.

The Supreme Court did not go into the merits of the application.

Redwing Interim Corporate Rescue Partner (ICRP) Knowledge Hofisi had already come up with a rescue plan which included the settlement of proven liabilities, reconstructing the balance sheet, resumption of underground mining, security of employment to ensure optimal benefit to the economy.

The arrangement entailed that proceeds from the distressed firm would accrue to the account of the corporate rescue manager who, in turn, would pay workers.

Hofisi was quoted by local media as saying the company needed US$6 million to restart production by bringing new investors into the business.

Scott Sakupwanya takes advantage of confusion

The initial granting of corporate rescue allowed politicians, particularly Zanu PF’s Pedzisai “Scott” Sakupwanya and his Better Brands Mining to annex the mine in 2019 under an opaque Tributary Agreement controversially facilitated by Hofisi.

The agreement is under challenge by workers who now report that they have been barred altogether from the processing plant.

Workers have also flagged the arrangement for failure to have a rescue plan to pay creditors and any job security guarantees.

Speaking on condition of anonymity, mine workers also accused company directors of individually benefiting from the secret arrangement, hence their lack of enthusiasm to pursue the restoration of company operations still in the hands of Better Brands.

Sakupwanya’s mobile phone was not reachable for comments. He did not respond to text and WhatsApp messages.

Redwing human resources manager Oscar Madhume refused to entertain questions when called to shed light on the dictates of an agreement.

“Who gave you my number?” Madhume responded when called on his mobile.

“I am sorry I cannot entertain you on the phone.”

Madhume was not forthcoming either when subsequent efforts were made to secure an appointment over the matter.

A tributary agreement is an instrument by which the holder of a claim or mining lease agrees to allow another person to work the claim or lease, or part thereof, in return for a proportion of the value of production or profits of working.

Because it does not have equipment to pursue underground mining, Better Brands unlawfully partnered small-scale miners, known as sponsors, to perform unsafe surface mining, resulting in chaos.

Farai Maguwu, director of a prominent environmental rights lobby, the Centre for National Resources Governance (CNRG), described Sakupwanya’s entry as more inclined towards serving political as opposed to business interests of the company.

“It was very political; the way they came there. Initially they claim they wanted to revive Redwing Mine,” said Maguwu.

“No sooner had they taken over the mine than they started operating the 134 tributary claims of Redwing Mine. So, they shifted the methods of operations from underground mining to artisanal mining.

“That is when they brought an army of makorokoza (gold panners) to start operating in the 134 tributary claims.

“The result has been ecological disaster; there has been social disaster there. People have been dying like flies because Better Brands is not a mining company. It is simply someone who has political power and using that power to coordinate makorokoza to operate at a colossal mine. They don’t have the capacity.

“The shoes left by Mzilikazi Khumalo are too big to be filled by Scott Sakupwanya. He does not have the capacity to operate that mine any further. Operations by Scott Sakupwanya are simply sacrificing other people’s children for him to be rich.”

The gold sold to the Reserve Bank of Zimbabwe through Fidelity Printers and Refiners is also considered dirty gold because of the problems associated with the manner in which Better Brands is producing the precious mineral.

The country is losing gold through leakages whereby the metal, instead of going to Fidelity — government’s designated buy of bullion — finds its way into the parallel market.

Who is Scott Sakupwanya?

Known by his moniker, Mr Gold, Pedzisai “Scott” Sakupwanya is the wily gold baron whose claim to fame does not extend further than his links to President Emmerson Mnangagwa and family.

The flamboyant Zanu PF politician fits the label of mbinga, street lingo for wheeler-dealers who flaunt impressive bling but with no traceable sources of riches except their proximity to influential politicians on whose behalf they act as fronts for opaque deals.

Sakupwanya has no traceable mining history and, by his own admission in Al Jazeera’s “Gold Mafia” documentary aired in April, acts as a middleman for gold dealers.

“I collect money from investors, buy gold and sell to RBZ (Reserve Bank of Zimbabwe) and then make a profit, and you get 10%. The money will be deposited wherever you are around the world,” Sakupwanya said.

Sakupwanya is accused of abusing gold licences, buying gold and delivering less than 50% to Fidelity Printers and Refiners, and smuggling the rest to other countries.

His company delivered 19 tonnes to Fidelity last year.

A visit to the mine reveals chaos, decay

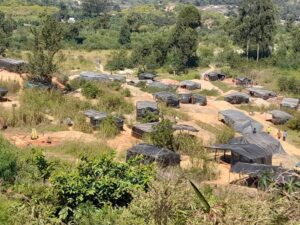

A visit to the mine shows a landscape cluttered with makeshift plastic structures and hordes of youths, some as young as 17.

The shacks were erected by artisanal miners. Under the shacks are very deep pits.

There are five sections designated and managed as mining sections by Better Brands and sponsors.

Sponsors, the middlemen between Better Brands and artisanal miners, supply plastics, timber, generators, food, blowers, worksuits, gumboots and pit registration for the miners.

There is a semblance of control as each pit has a peg number pasted against the shacks.

Sections designated as mining areas are Nhasi Nhai, Rezende, Tylor, Tsapauta but there are hordes of other youths who have invaded the landscape outside the controversial arrangement to dig for the precious mineral.

Meandering footpaths leading to the pits is dicey as it is easy to plunge into deep holes dug and abandoned just on the verges of the paths.

Moving around the area is not the most comfortable experience for a newcomer as one is greeted with curious eyes of soiled miners, some taking a nap on piles of timber to ease fatigue exerted by the energy-sapping job.

It is easy for them to sniff out a stranger because locals wear soiled clothing which is now some kind of de facto uniform and symbol of identity for the miners.

The area is a cacophony of shouts and roaring generators, used to blow oxygen into the mine shafts, some as deep as 50 metres.

Under cover, this reporter saunters into one of the shades asking if they could offer his sibling a job, to which one of the miners excitedly responds in the affirmative but emphasises that the prospective employee should be tough enough for the grueling job.

“If you are really interested, please do that fast because we don’t recruit lazy people. We need people who dig. Can you see this hole, I dug it only in five days,” says an unidentified artisanal miner while showing off a hole he claims to be 22 mitres deep and a shaft that is eight metres long.

He continues: “The underground is so free that you may think that it is a real home. You can easily spend the entire day underground and not even sense it that you are beneath earth.”

For toilets, he said, a small plastic container is lowered to workmates under the earth to fill up with urine which is then hoisted to the surface and deposited in the immediate environment.

The makeshift plastic shelter is used as a bedroom, storeroom and cover against rain and avoid water filling into the pits.

Vendors, some from as far as Mutare and Mozambique, also crisscross to and from the various mining sections selling braziers, soap, towels and food, among some items.

There are no toilets on site.

Operations spur environmental damage, social ills and death

According to CNRG, Better Brands is responsible for at least 5,000 open pits that it is not reclaiming.

There are over 2,000 miners at any given time, each of them having a pit.

Better Brands employees have also contributed to some of the social ills seen through illegal mining, gold leakages, land degradation, pollution of Mutare river and an increase in criminal activity as the panners, when they get broke, often become a menace through committing robberies in the Penhalonga area.

Most of the illegal miners are undocumented, hence difficult to track when they commit the crimes.

A report by Mutare City Council last year confirmed water in Mutare River contains samples of cyanide.

Mutare River is a source of water for Redwing Mine compound, home to over a hundred residents.

Previous investigations have shown that Better Brands’ operations were in violation of Statutory Instrument (SI) 258 of 2018 Environmental (Zimbabwe) management (Control of Alluvial Mining) (Amendment) Regulations, which outlaws the setting up of washing plants, ore stockpiles, slime dams or mining ponds within 500 metres from a riverbed.

Some of the social ills include child pregnancy and school dropouts.

Speaking at a recent Press conference, Penhalonga Youth Development Trust director Clinton Masanga said: “There are people who have set up several illegal hammer mills leading to cyanide and mercury pollution. As a community group, we are advocating for good governance in natural resources.

“Mutasa Rural District Council has no source of revenue except taxing residents when we have big projects like Redwing. We are calling for a structure where the community benefits.”

Masanga said gold leakages at Redwing Mine had reached levels where there are now more than 522 illegal gold hammer mills and 10 cyanidation sites on the steep slopes and river valleys of Penhalonga, processing an estimated seven kilogrammes of gold on a daily basis.

“It is alarming to note that all these processing sites are not mining gold at their claims. They receive stolen gold ore from Redwing Mine day and night.

“Sources at Redwing alleged that mine officers were operating illegal hammer mills outside Redwing Mine hence the laxity of security at the mine.

“An expert calculation of an average of 2 000 bags of ore being transported from Redwing Mine said the output is an average 7kg of gold,” said Masanga.

He further noted that Redwing Mine, at its peak in the early 1980s, produced between 35kgs and 45kgs and the community benefitted through employment opportunities.

Masanga said the company is not playing its role in enabling responsible mining.

“There is chaos and what we seek is sanity. We want the project to resume underground where it is safe and does not disturb the ecosystem or environment with no land degradation,” he said.

“Surface mining being undertaken is not sustainable and some geologists have confirmed our fears because the ground is putting people in danger.”

He said some people who lost their lives at the mine were from neighbouring Mozambique.

According to CNRG, over 26 deaths were recorded by civil society groups in January 2023 alone, as miners risk lives by plunging into unsafe disused tunnels.

In a joint statement in January, CNRG, Zivai Community Empowerment Trust, Penhalonga Youth Development Trust and Penhalonga Residents and Ratepayers Trust, said over 100 artisanal miners have died at the mine since 2020.

In its operations, Better Brands is accused of recruiting some workers who do not have national identity cards. Their origins cannot be traced.

Some of the people who lost their lives at the mine are believed to be from neighbouring Mozambique.

CNRG last year filed a petition to parliament demanding to know if the Ema is properly executing its mandate of monitoring environmental management and compliance at the mine.

By its own admission, Better Brands acknowledged surface mining has brought a lot of challenges. In January this year, the company announced a suspension of operations in compliance with Ema’s directives.

In a letter dated January 20, Better Brands said it would suspend operations at Redwing Mine, temporarily, until matters of increased number of fatalities, environmental degradation and constrained access controls are resolved.

“Better Brands mining hereby advises its valued stakeholders that all surface mining operations shall be suspended with immediate effect; mainly due to concerns in the increased number of fatalities, environmental degradation and constrained access controls,” general manager Cuthbert Chitima announced.

“Better Brands Mining shall take this opportunity to restructure and rehabilitate the mining field in preparation for resumption of surface and underground mining operations.”

But civil society groups say the company, which enjoys impunity because of its owner’s proximity to the ruling elite, did not close shop as instructed and as announced.

This has heightened anger and impatience with the company among workers and the community.

While Better Brands, is officially selling to the RBZ, there are strong suspicions by community-based interest groups that some of the gold it produces through artisanal miners is illicitly finding its way into the world market as laundered gold.

We are living in poverty: workers

Phanuel Mukadiweyi who chairs a workers’ committee, says workers are living in abject poverty and have nowhere to start.

“No one seems interested in the proper re-opening of the mine,” Mukadiweyi said.

“The proper re-opening of the mine should start with de-watering. Nothing is happening now. We are living by the grace of God.

“Better Brands is using a tributary agreement which was scrapped by the court. They are still on the ground anyway but do not have any meaningful contract that binds them to remit any payments, they just bring money as and when it is convenient for them, unlike the first contract last time.

“The situation has worsened. Since it was removed from corporate rescue, no operations are taking place, Better Brands is operating and we continue to sink deeper into financial doldrums, failing to pay dues to trade unions.”

A section of the company workforce led by Peter Zheke, Victor Zivanai and Peter Chirakaraka has since re-opened their bid to seek corporate rescue under Commercial Court Case HC250/2022.

They argue that the company must be placed back into corporate rescue under Hofisi so that they are paid their outstanding salaries. The matter, due for initial hearing on 5 June, 2023, was filed under Kadare Legal Practitioners.

Kadare adamantly refused to share details of the matter, saying it is still before the courts of law.

“I am not at liberty to disclose anything for now because the matter is sub judice. Until such a time when the matter is finalised then it can become public,” said Kadare.

Reached for comment, Metallon Corporation distanced itself from the rot at Redwing and also denied being culpable for the botched investment.

In emailed responses sent to ZimLive through company public relations manager Ranga Mberi, Metallon said corporate rescue proceedings were a result of “unfavourable trading conditions in Zimbabwe at the time, such as delayed gold payments and exchange rate disparities, which affected many mining operations, including those of Metallon Corporation”.

“These conditions affected the company’s ability to adequately fund working capital and critical capital expenditure,” said the company, adding that the crisis started when corporate rescue came into effect when “the operation was outside the management of the Company”.

“It was during this period that operations were regrettably overrun by illegal mining activities while imprudent commercial decisions were made.

“As a consequence, there was a disregard for basic safety measures and other statutory obligations.

“As widely reported in the national media, this has resulted in avoidable injuries and deaths at Redwing Mine, and also resulted in a significant loss of value to the national economy,” Metallon said.

The company said it had plans to put an end to the crisis.

“The Company is now consulting concerned partners to ensure that any tribute agreements in place at Redwing Mine are enforced under established and strict mining standards for the safety of miners, the community and the environment.”

Metallon also said it was in the process of “consulting all relevant stakeholders to ensure a swift transition back to formalised and safe mining operations at Redwing Mine that benefit the community and the economy.”

We are happy: Zanu PF

Despite the evident rot brought by the entry of Better Brands, local Zanu PF legislator Moses Mugadza said the local leadership was monitoring progress at the mine to ensure that the Ema directive is followed.

“We are satisfied with the progress that the investor has made in rehabilitating the mine as prescribed by Ema and I think the progress recorded so far is at 90%. We expect the mine to start operating soon under the conditions prescribed by Ema,” he said.

The Penhalonga community and civil society groups however remain concerned by deaths, environmental damage, social ills, crime and the impunity at Redwing.