HARARE – Financial advisory and investment company Bard Santner Markets Inc has closed a deal to take over Tetrad Financial Services (TFS)’s managed clients portfolio through its subsidiary Bard Santner Investors to unlock value for its new long-shortchanged clientele base.

The Harare-based Bard clinched the transaction after a rigorous process of shortlisting, due diligence and selection which looked at various factors, including capacity, skills and entrepreneurial cutting edge, an official said.

This led to Aurifin Capital, the liquidator of Tetrad Holdings, which own Tetrad Financial Services (TFS) and Tetrad Investment Bank Limited, and Bard Santner Investors issuing a public notice on Wednesday on the business arrangement.

“Clients of TFS Management Company (in liquidation) (“TFS”) are hereby advised that the TFS Managed Clients Portfolio, made up of individual investors, which has been under TFS has now been transferred to Bard Santner Investors (Private) Limited (“BSI”), an asset manager licensed by the Securities and Exchange Commission of Zimbabwe , with effect from 1 September 2022,” the notice said.

The Tetrad clients portfolio now under Bard includes individuals, well-established pension funds, private companies and unit trusts, as well as listed and unlisted entities and money market investments.

The deal came after a market assessment of who to appoint to manage the Tetrad book and a due diligence process.

Bard won it due to its blend of local knowledge, experience and international expertise, as well as capacity to deliver.

Markets sources say the move indicates Bard’s growth and consolidation strategy which seeks to position it as an ambitious new kid on the block in the dynamic local financial services market.

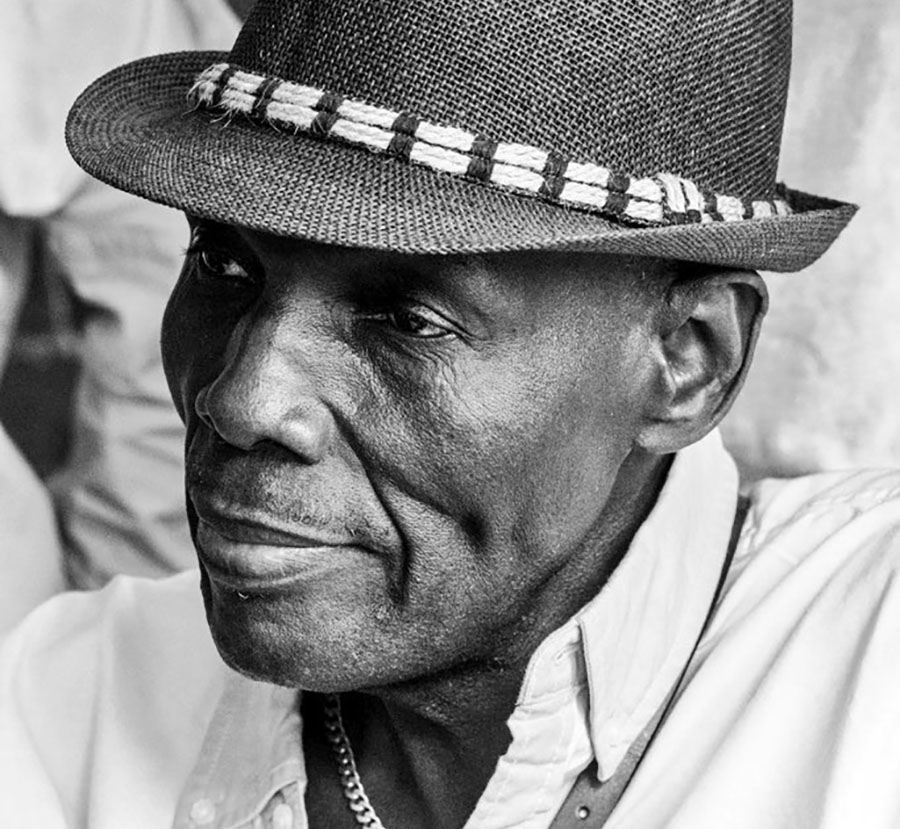

Bard is led by local banker Senziwani Sikhosana, who is the chief executive, with over two decades experience in banking, investment, property, and capital and money markets.

Sikhosana works with a local business consortium which includes Tatenda Hungwe, Alfred Mthimkhulu and international finance expert Vinod Bussawah from Mauritius.

Hungwe is executive director of the company and Mthimkhulu is head of Bard Santner Investors, the firm’s asset management arm, while Bussawah is the chairperson.

In an interview yesterday, Mthimkhulu, a former stockbroker who holds a PhD in finance and ex-lecturer at Stellenbosch University in South Africa and National University of Science & Technology in Zimbabwe, said the move is a significant growth and consolidation step for Bard.

“The handing over is a stepping stone in our long-term strategy to find build and grow a diverse asset management portfolio which is responsive to the new and prevailing economic environment,” Mthimkhulu said.

“Investments within the local and international markets have fundamentally changed and technology has also changed the way we invest and manage investment in the local and international markets. We are bringing to the market innovations that will allow local investors access to global markets and financially re-engineer global solutions for adaptation to local conditions.

“We are excited to have this opportunity to service the investors in the book we have inherited and will be working with the liquidator, the clients and other institutions to bring out the latent dormant value for the investors.”

Sikhosana, the Bard boss, said the deal is in keeping with the company’s strategy to find and reactive value in dormant asset portfolios in the market, while tapping into diaspora investment capital and seeking new opportunities in frontier markets.

“We see our appointment as an endorsement of Bard in investment management and asset management in Zimbabwe. This move is in keeping with our strategy to find and reactivate dormant asset portfolios in the market, similar to our recent launch of a product where we are unlocking investments in paid up offshore properties in South Africa,” Sikhosana said.

“Dr Mthimkhulu, who heads the Bard’s asset management division is a seasoned professional who has taught finance at the highest levels at universities and provided thought leadership in this industry for many years. The local and international financial expertise and skills within Bard are some of the best in the market. This has given the market confidence in us.

“This deal is an indication of how the market trusts us and a demonstration of its confidence in our vision, mission and strategy of bringing unlocking value in dormant assets, mobilising diaspora funds for investment locally and securing new lines of credit.”

Sikhosana said Bard will help Zimbabweans unlock value in their assets most of them constituting dead capital outside the country and access new lines of credit.

The dead capital is mainly tied in immovable properties like houses and buildings which Zimbabweans own outside the country but are not leveraging to raise capital to invest there and back home.

The new lines of credit the advisory firm has arranged are the in the form of offshore transaction-based funding which does not need individuals or companies to be clients of financial institutions providing the money.

Bard will arrange transaction-based deals and associated funding.

Hungwe has said securitising internationally-held assets is critical as it would allow capital-seeking individuals and corporates to borrow offshore in markets where the macro-economic fundamentals, especially interest rates, are stable and repayment terms favourable.