HARARE – The government on Thursday failed to deny claims by central bank adviser Eddie Cross that a new currency will come into circulation in November.

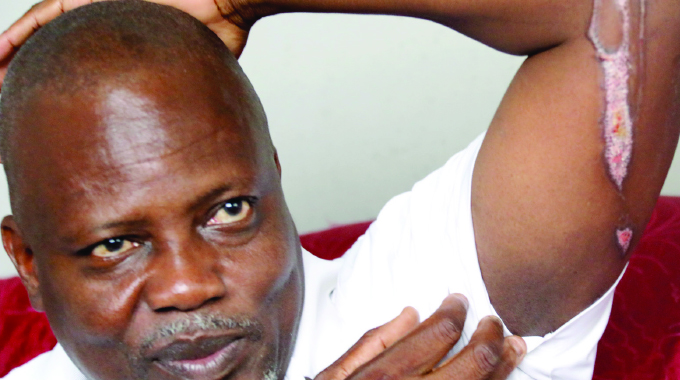

Cross, recently appointed to a newly-established Monetary Policy Committee advising the Reserve Bank of Zimbabwe, told the ZBC on Wednesday that a new currency was due in November.

In a statement on Thursday, government spokesman Nick Mangwana said Cross “does not speak for the government of Zimbabwe, neither does he speak for the RBZ.”

“His views are personal and not indicative of the government’s policy thrust,” Mangwana said.

Crucially, the information ministry secretary did not deny claims by Cross that a new currency will come into circulation in November. Cross stood by his claims.

“The RBZ will regularly inject money into the economy in a measured way. The government will continue to give the nation updates on currency reform as and when necessary,” Mangwana added.

Recent currency changes by the RBZ have caught the public by surprise, starting with the decision to allow the RTGS currency to float in February.

In June, when the RBZ announced an end to the use of a basket of foreign currencies and the return of a currency called the Zimbabwe dollar – made up of the RTGS and bond notes and coins – the notice was issued less than 24 hours before the directive became effective.

On Thursday, Cross stood by his comments to the ZBC.

“It’s nothing new (what he said). The president announced a few months ago that we will have a currency by November. The delays were because of printing otherwise it would have been introduced in September,” he insisted.

Cross had told the ZBC that “we have insufficient cash in the system to meet people’s needs for transactions.”

He added that the new currency “should do away with the queues at the banks and people then should have adequate money for daily use.”

Last week, the government banned cash-in and cash-out services on mobile currency transactions. In announcing the moves, the RBZ said it would be injecting cash into the banking system soon to address a cash shortage that had opened arbitrage opportunities for mobile money traders.

“The RBZ will be injecting cash into the economy without changing money supply,” governor John Mangudya said in an October 1 statement clearly pointing to an ongoing process to print billions in new notes. “In this regard, banks will exchange existing RTGS balances for cash thus maintaining the monetary base unchanged.”

In February, Zimbabwe had around RTGS$10 billion in RTGS balances in the banking system, but very limited bank notes and coins in circulation which has seen pensioners, war veterans and workers who need cash spending hours in bank queues to be given just Z$100 – which is now just enough to buy a chicken and a loaf of bread.