HARARE – If you thought Argentina’s currency crisis was bad, spare a thought for Zimbabwe.

Measures to protect the Zimbabwe dollar – including sky-high interest rates – seem to be coming to naught.

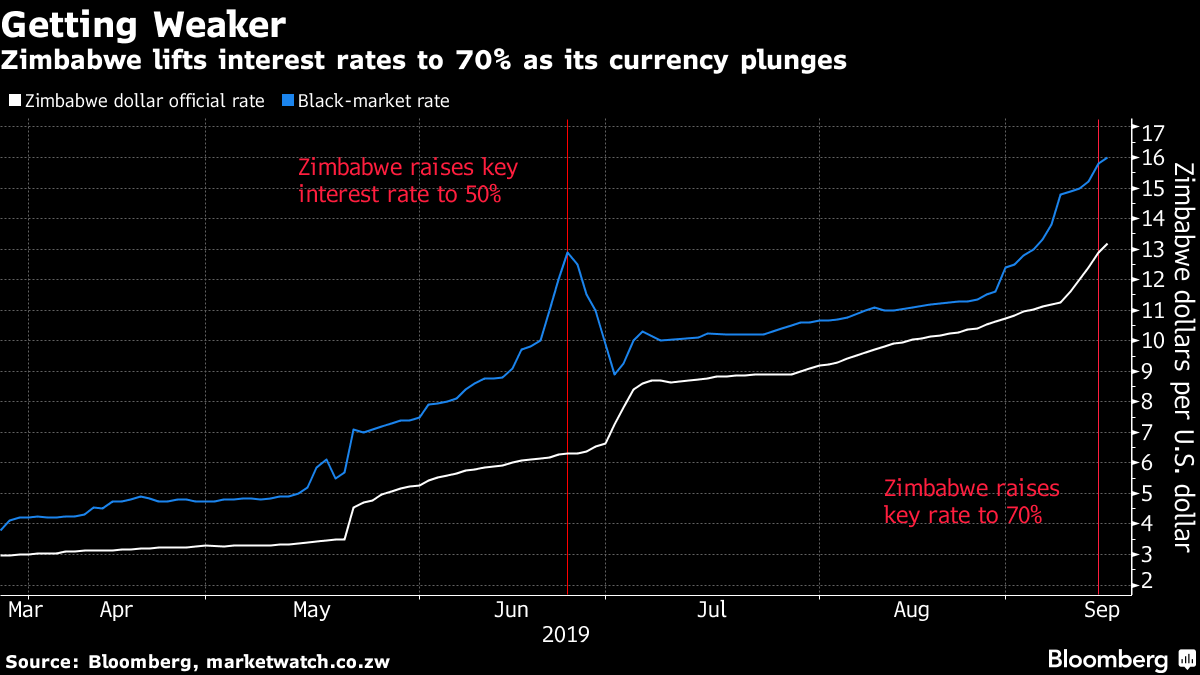

Since the country allowed formal trading of what was effectively a new currency in February, the unit has depreciated to 13.52 per U.S. dollar, from 2.50. That equates to a loss in value of 82 percent – easily the worst performance globally, excluding hyperinflationary Venezuela.

It’s even weaker on the black market, changing hands on the streets of Harare, the capital, at 16.60, according to marketwatch.co.zw, a website that monitors the parallel rate.

The rout makes that in Argentina, where the government imposed capital controls to stem the peso’s 26 percent decline last month, seem relatively mild.

Zimbabwe’s foreign-exchange scarcity has only worsened since long-standing ruler Robert Mugabe, whose funeral was held over the weekend, fell from power almost two years ago. Such is its severity that the central bank raised interest rates to 70 percent on Friday, from 50 percent.

That may do little for consumption in an economy the International Monetary Fund says will contract 2.1 percent this year, but Zimbabwean officials believe it’s necessary to slow inflation, the rate of which is estimated to be above 200 percent. – Bloomberg